There’s a sense of purpose at Canadian junior Potash Ridge – and the tone is set by its President and CEO Guy Bentinck a Chartered Accountant who has devoted the 20 years he has spent in the mining sector to finding smart ways of securing finance. He is not a man whose head can be turned by specious arguments: every step in the development of a project has to be considered, and realistic contingency planning built in.

Still, it’s impossible to miss the excitement and real passion behind his proposals for the company’s Blawn Mountain potash deposit. At first glance the pace seems to have been a breakneck one since he joined the company two years ago, at a point where Potash Ridge had done no more than acquire the rights to the property, in which it has a 100 percent interest.

There’s a good explanation for this fast track development. In two years the project has come from virtually nothing to being a project with 40 years’ worth of reserves and a pre-feasibility study (PFS), completed November 7, that demonstrates its technical and economic viability. It has a lot to do with the fact that this is a well-understood resource, explains Bentinck: “This deposit was extensively evaluated in the 1970s, not for the potash but for alumina.” At the time, potash was of little interest compared to the alumina that the alunite ore also contains. The equivalent of $100 million at today’s values was spent in proving the resource and getting it ‘shovel ready’, and a pilot plant based on well understood technology ran satisfactorily for three years before the market for alumina collapsed, and with it the prospects for financing Blawn Mountain.

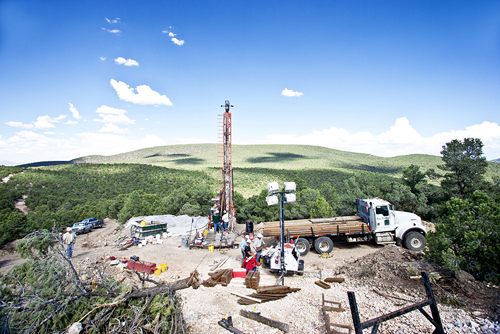

In April 2011, Potash Ridge gained ownership of all the historical data that had been amassed: “Boxes and boxes of drilling results, engineering reports, test work, permitting applications and the like fell into our lap and allowed us to develop the project very quickly,” he says. “And we expect to be able to continue to use the historical data from the remaining part of the resource, which does not, however, form part of the basis for the PFS.”

Development has been helped by other factors too. For one thing, all of the property is on land owned by the State of Utah. It is a lot harder to get a project permitted if it is on federal land and has to go through agencies like the Bureau of Land Management, the Corps of Engineers or the EPA, which are notoriously restrained where resource developments are concerned and very slow to take decisions. Utah, whose resources play a major part in the State economy, on the other hand takes a very ‘can do’ approach to mining.

It is not hard to see why the state would want to support Potash Ridge. The land that hosts the deposit is owned by the School and Institutional Trust Lands Administration (SITLA), whose land holdings are all designated for development in one form or another. “The basic business proposition is that the revenue derived is earmarked for education in Utah. We are going to be paying the School Fund around $30 million a year in royalties when we are up and running,” says Bentinck. Add to that more than a billion of capital investment in this remote part of the state, and the creation of around 500 full time jobs and the case for development is unassailable.

As long as it does not go the same way it went in 1980, that is. Well that is where Guy Bentinck shows his crusading side. He is looking for every opportunity to make understood the distinction between MOP and SOP. Let us get it straight from the start: Potash Ridge is focused on sulphate of potash (SOP), a premium potassium source that is used in crops that are sensitive to chloride or fertiliser burn. Tobacco, pineapple, soft fruits, salad crops, apples oranges and avocado are all examples and there are plenty more. Growers of these crops have two choices – SOP or nothing.

Muriate of potash (MOP) is the most common potassium source used in agriculture, accounting for about 90 percent of all potash fertilisers used worldwide. A few plants like sugar beet actually like chloride; many tolerate it including leaf crops and soya, but the presence of chloride in many cases will reduce yields. If the chloride content isn't managed, it can lead to low quality crops and inhibit plant growth in dry soils and saline areas.

That SOP is a separate product, not a niche subset of regular potash has been graphically demonstrated over the course of 2013. MOP prices slumped from over $400 a ton to close to $300 following the collapse of a Russia/Belarus cartel, but over the same period SOP prices in North America rose. “The tenuous link between MOP and SOP in people’s minds really does not seem to be there any more. The supply dynamics of regular potash don’t exist with SOP and the market impact on regular potash has not affected SOP one iota: that is the competitive advantage of our project as against many other regular potash development companies.”

The PFS that is currently giving Potash Ridge a warm glow is in fact a very conservative document. It does not take into account any potential alumina by product credits, and the closer one looks at it the lower the risk appears. Contingency elements of around 15 percent have been built into capex and opex estimates; the jurisdiction is friendly, the infrastructure available and the deposit is a surface one, unlike so many potash resources. The fundamentals of potash are sound, as the world strains to get more productivity from less agricultural land, and the product gets an additional fair wind from the growing recognition of sulphur as a plant nutrient. “When legislation was enacted to require scrubbers to remove SO2 emissions, crop yields started declining!”

When the alunite ore is roasted as part of the SOP process, SO2 is driven off, captured, and converted into sulphuric acid. That will provide an additional revenue stream, as will the alumina, which was after all what the deposit set out to produce 40 years ago, so there’s quite a bit of it. The residue from the leaching process is alumina rich, and though it does not form part of the current business case for the mine this could yield significant tonnage of material suitable for sale as a substitute for bauxite in smelting plants – there is a strong demand for this material, he says, especially from China. Another potential market is to sell the material as an ingredient in manufacturing ceramic proppants used to keep hydraulic fractures open. With shale gas deposits taking a front seat in global energy markets, this is a growing procedure, and these proppants are an essential part of it because they perform much better than sand.

Potash Ridge is expecting to produce 645,000 tons of SOP each year, and 1.4 million tonnes of concentrated sulphuric acid. The company now plans to embark on a full feasibility study (FFS) early in 2014, permitting activities are already underway and offtake arrangements for sulphuric acid production are going well, with an agreement already signed with a purchaser to take 20 percent of acid production. “We are currently negotiating with third parties on build, own and operate contracts to provide gas, power and water assets at the site.”

He is confident he will be able to start construction in 2015, to start commissioning the process plant in 2017 and reach full production in 2019. “My primary focus here is on expediting the project. Too many projects today get stalled because management did not think through the financing arrangements early enough.” This is not a trap that Guy Bentinck will allow Potash Ridge to fall into: however he does have one big remaining challenge, and that is to bring on board a joint venture partner to take a good proportion of SOP production, to share the capital cost of development and maybe also smooth the way to borrowing such sums as may be required along the road to sustainability and profitability in the future. Discussions are already under way, and with the PFS out of the way, these will gain momentum in the new year.

Written by John O’Hanlon, research by Richard Halfhide

PotashRidge-AM-Mining-Dec13-Bro-s_0.pdf

PotashRidge-AM-Mining-Dec13-Bro-s_0.pdf